Betroet af millioner af brugere

Auto-tracking

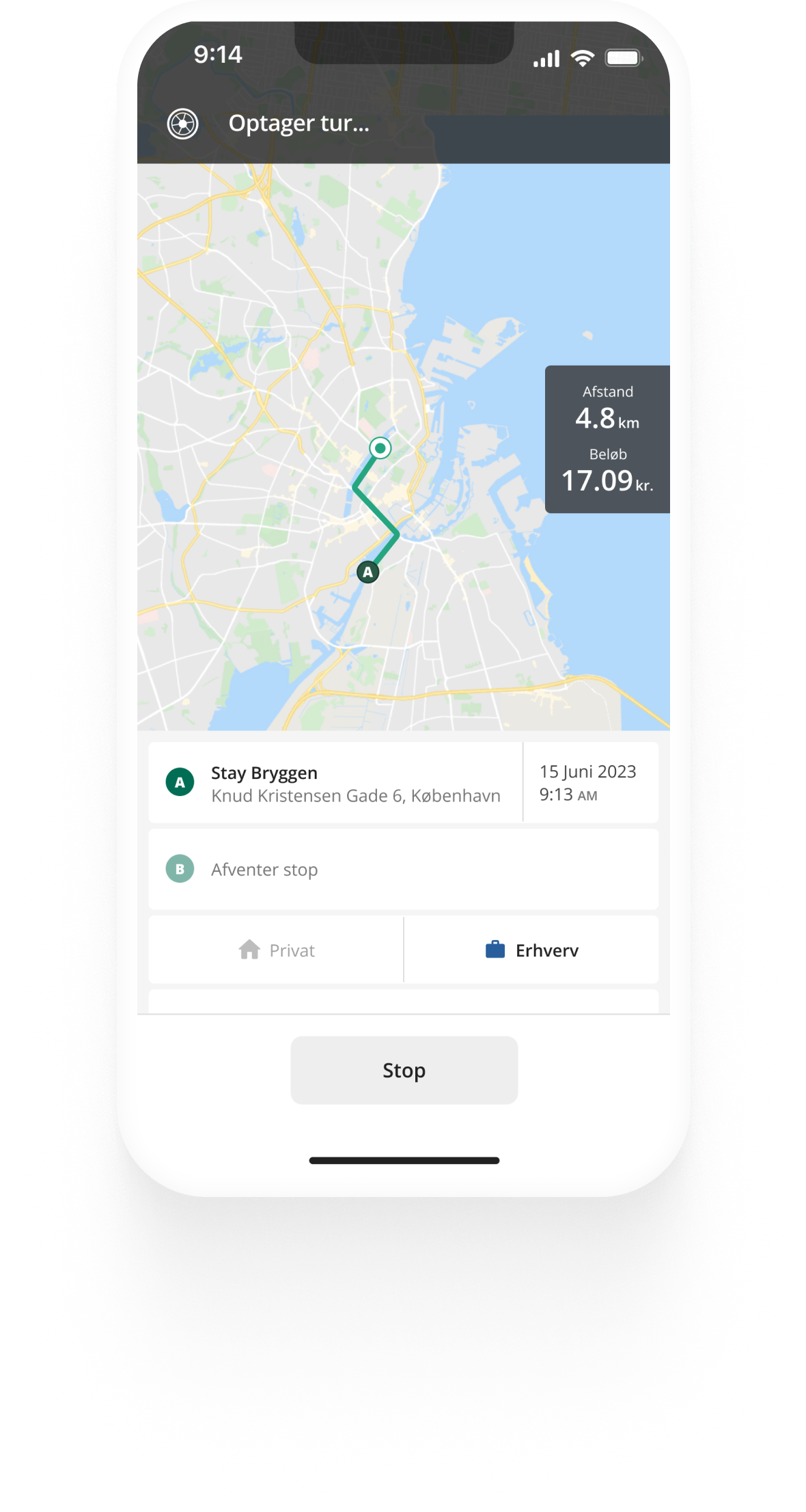

Registrer kørsel fra din lomme

Driversnote gør det muligt at registrere kørsel automatisk. Ved hjælp af bevægelsessensoren i din telefon, auto-tracker appen dine ture uden du behøver at åbne den. Alt du skal gøre er at køre. Du kan nemt gennemse dine auto-trackede ture i appen og tilføje ture manuelt.

Læs mere Tilmeld dig

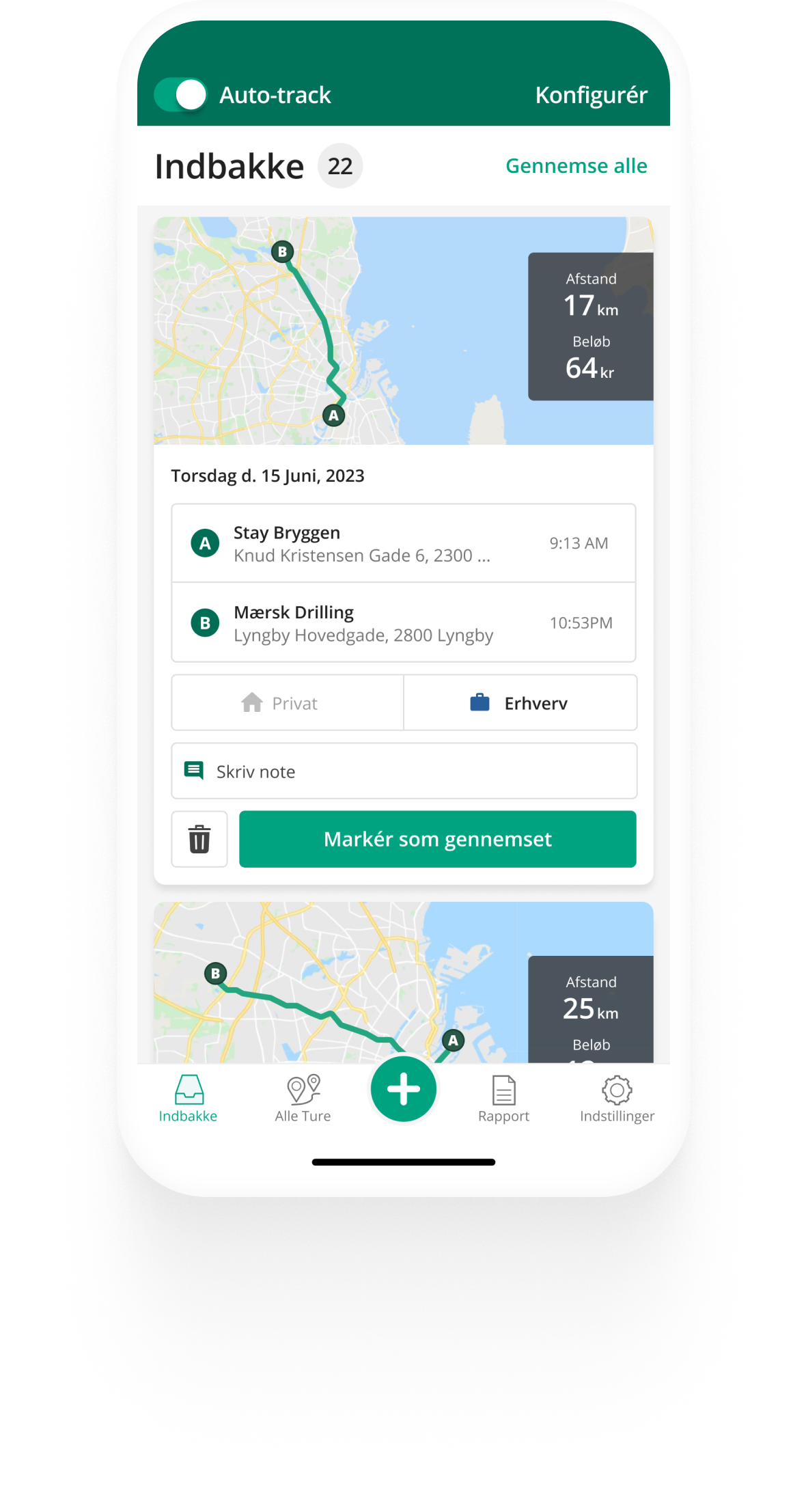

Klassificer

Hold din kørebog opdateret

Gennemgå og godkend dine ture med Driversnote. Få det fulde overblik, administrer og kategoriser ture som erhverv eller privat, og tilføj noter - i appen eller på hjemmesiden.

Læs mere Tilmeld dig

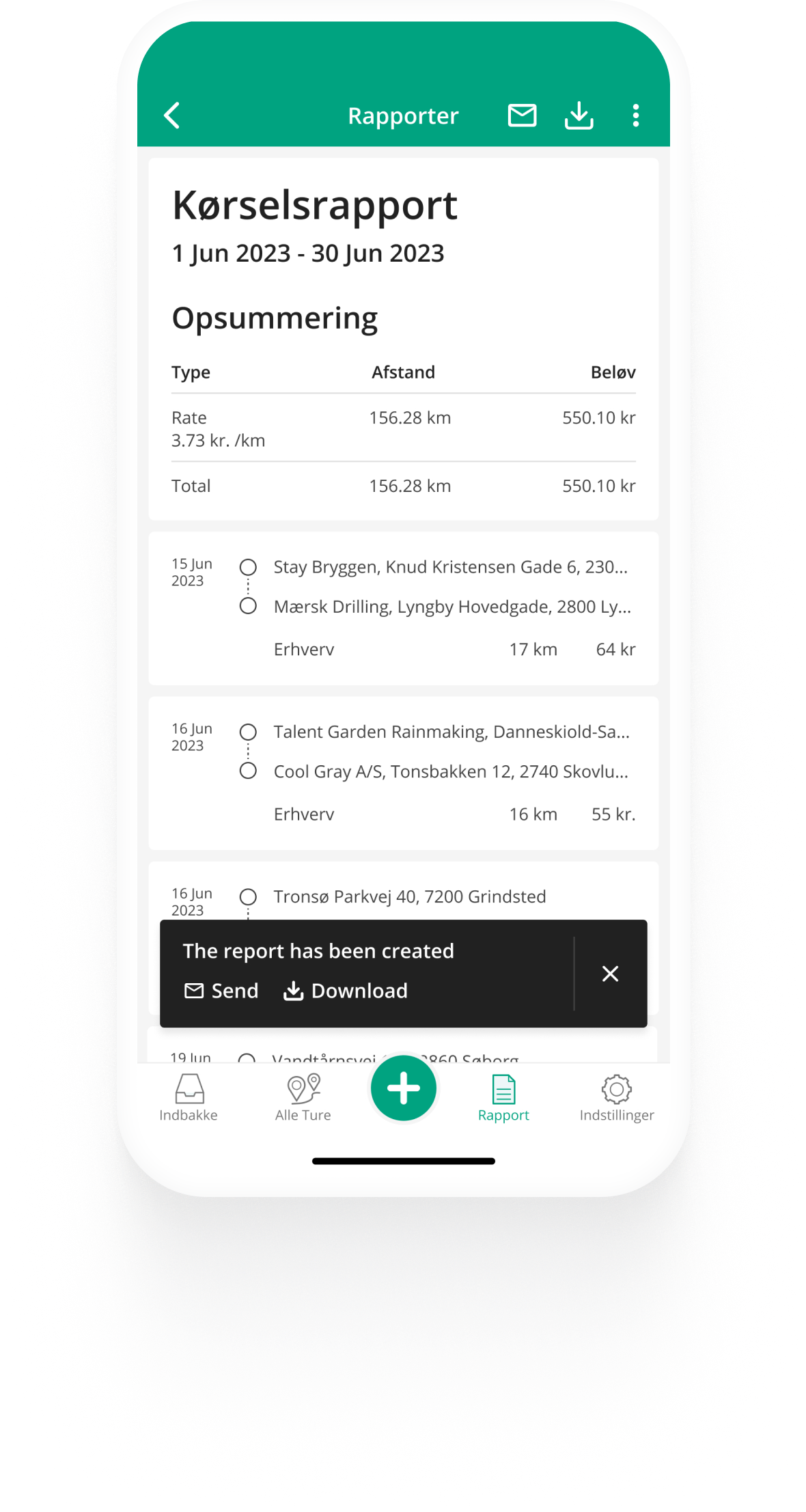

Rapporter

Den lettelse måde at sikre, at din kørebog lever op til SKATs krav

Opret og download når som helst dine kørselsrapporter i PDF eller Excel format direkte fra Driversnote appen eller hjemmesiden. Del dem derefter med din arbejdsgiver eller revisor velvidende, at de lever op til SKAT’s krav til kørebøger.

Læs mere Tilmeld digHvad vores kunder siger om os

Super god

Genial app Den er jo super nem og lige til . Genialt man kan gå tilbage i tiden . Kan klart anbefales

virker virkelig nemt!

Let forståelig Det vil være fordel hvis man ikke skal skrive tidspunkt selv, istedet rulle tiden. Kæmpe fordel med at taste alt på computeren. Godt tænkt og udarbejdet. Købt årsabonnement samme dag. Tak

Super løsning Jeg har haft driversnote i nogen år. Jeg er super tilfreds. Den holder fint styr på min kørsel så en opgørelse af kørsel. Når der har været nogle problemer med brugen, er supporten meget hurtig, og har hver gang løst opgaven fint.

Genialt værktøj Nemt og hurtigt værktøj til at registrere og videresende kørselsregnskab, som PDF.

Let forståelig Det vil være fordel hvis man ikke skal skrive tidspunkt selv, istedet rulle tiden. Kæmpe fordel med at taste alt på computeren. Godt tænkt og udarbejdet. Købt årsabonnement samme dag. Tak

Super løsning Jeg har haft driversnote i nogen år. Jeg er super tilfreds. Den holder fint styr på min kørsel så en opgørelse af kørsel. Når der har været nogle problemer med brugen, er supporten meget hurtig, og har hver gang løst opgaven fint.

Genialt værktøj Nemt og hurtigt værktøj til at registrere og videresende kørselsregnskab, som PDF.

Rigtigt godt Fungere rigtigt godt, enkelt og rart at får styr på sin erhvervs kørsel.

Nemt at bruge Lige startet op. Virker super godt. Skønt at app’en virker i baggrunden, da jeg er slem til at glemme, at skrive start og slut ned manuelt

Battery problems finally solved and now the app is absolutely great :)

Rigtigt godt Fungere rigtigt godt, enkelt og rart at får styr på sin erhvervs kørsel.

Nemt at bruge Lige startet op. Virker super godt. Skønt at app’en virker i baggrunden, da jeg er slem til at glemme, at skrive start og slut ned manuelt

Battery problems finally solved and now the app is absolutely great :)

Funktionerne der gør det nemt at holde en kørebog

Opret steder

Log dine ture hurtigere ved at gemme steder du ofte besøger.

Flere køretøjer

Log kørsel og hold separate kørebøger for flere køretøjer.

Flere arbejdspladser

Log kørsel og hold separate kørebøger for flere arbejdspladser.

Arbejdstider

Indstil dine arbejdstider og lad appen kategorisere dine ture automatisk.

Påmindelse om rapportering

Indsend din kørselsrapport til tiden hver gang. Vi minder dig om det, når det er tid.

Satser for kørselsgodtgørelse

Få overblik over din kørselsgodtgørelse ved at tilføje dine satser til din kørebog.

Kilometertæller

Tilføj aflæsninger af din kilometertæller og indstil påmindelser for en komplet kørebog.

Log ture manuelt

Log dine ture manuelt, og appen beregner afstanden for dig.

Administrer dit Team

Gennemgå og godkend let kørselsrapporter i din organisation. Kontakt os for at lære mere.

Arbejdstider

Indstil dine arbejdstider og lad appen kategorisere dine ture automatisk.

Påmindelse om rapportering

Indsend din kørselsrapport til tiden hver gang. Vi minder dig om det, når det er tid.

Satser for kørselsgodtgørelse

Få overblik over din kørselsgodtgørelse ved at tilføje dine satser til din kørebog.

Kilometertæller

Tilføj aflæsninger af din kilometertæller og indstil påmindelser for en komplet kørebog.

Log ture manuelt

Log dine ture manuelt, og appen beregner afstanden for dig.

Administrer dit Team

Gennemgå og godkend let kørselsrapporter i din organisation. Kontakt os for at lære mere.

Ofte stillede spørgsmål

Ved at bruge en app til at logge din kørsel vil du spare tid, da du ikke manuelt skal notere alle detaljer for hver en tur. Vores app logger alle de nødvendige detaljer automatisk. På den måde sikrer du, at du lever op til din arbejdsgivers og SKAT’s krav til kørebøger, så du kan modtage kørselsgodtgørelse.

Appen fra Driversnote passer perfekt til selvstændige. Slå auto-tracking til og læn dig tilbage. Vores digitale kørebog registrerer dine ture fra start til slut med alle nødvendige detaljer for en komplet kørebog. Brug derefter dine kørselsrapporter fra appen som dokumentation for at modtage kørselsgodtgørelse.

Det kan du tro! Vores virksomhedsløsning - Team - passer perfekt til både små og store virksomheder. Organiser dine medarbejdere i et Team, så de nemt kan indsende deres kørselsrapporter til tiden. Dine medarbejdere sparer tid ved at automatisere deres kørselsregistrering, og du får nemt et samlet overblik over deres kørsel. Læs mere om vores Team løsning her.